Forecasting SEO with Total Addressable Market (TAM)

This week’s newsletter is sponsored by the Digital PR agency Search Intelligence. See their case study linked at the end of the newsletter.

Are you interested in taking a cohort-based course for product managers to learn about SEO that I am building with Kevin Indig? Please share your insights in this survey to help inform what we should teach and join our waitlist.

In last week’s newsletter, I shared that the standard process of forecasting for SEO using keyword search volume leads to deeply flawed estimates that have a near impossibility of being accurate.

It’s not just the process that makes SEO forecasts a challenge; it is inherently a complex channel with numerous unknown dependencies that make this source of revenue a difficult one to forecast. Nonetheless, marketers can’t just throw their hands up in resignation because that’s a sure way never to get resources allocated to this vital and potentially highly profitable channel. The alternative to inaccurate forecasts is not to avoid the whole question but instead to try to discover a better process that is more logical to understand and, ideally, more accurate.

Top-down forecasts

To accomplish this, rather than use the bottoms-up keyword approach, which I delved into in that prior newsletter, I start from the top. The best part about using this process is that if the logical thought exercise results in there not being a significant base of potential SEO users, then this channel can actually be safely ignored (as I have mentioned in a handful of prior newsletters.)

Additionally, this top-down approach will align with and be familiar to cross-functional partners who do their own forecasting. While there are different calculations and processes, familiarity should be enough to generate some consensus. When an unfamiliar process is presented, even if it is logical, it still has a more challenging time to be understood.

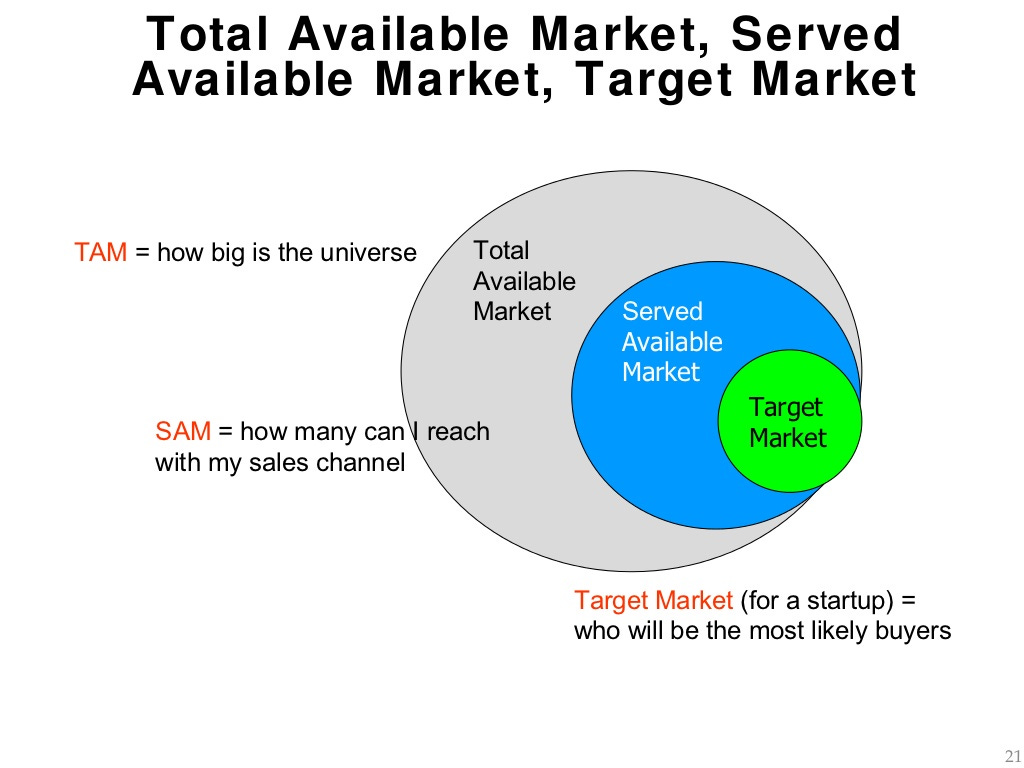

To begin this forecasting process, I start from the top of the market. If a company is engaged in the business of selling clothing to Gen Z females in the United States, I would calculate the precise number of Gen Z females in the United States. That is the absolute total addressable market, which, due to natural demographics, can only shift slowly over time.

Sales addressable market

With this total number, I then narrow it down by how many people in this audience might be “in-market” for the product I am selling. Within a vast audience, only a sliver of that audience will have the same tastes and behavior. This audience can be sliced down using existing data from other marketing channels, or it can be based on market research if past buyer behavior does not exist.

Continuing with our example of Gen Z females in the United States, according to Google’s Bard, there are 32 million people in this audience. Depending on the product being sold, there will be many modifiers to slice this audience. If the product is expensive, I might want to narrow this down to only luxury buyers. Bard says that 35% of Gen Z are luxury buyers, bringing my new TAM down to roughly 11 million.

I also would want to know how often they make this kind of purchase. Is it annually, which means the TAM stays the same - but over a whole year, or is it biennial, which means the annual TAM is immediately cut in half?

Target market

Another and potentially the most essential slice for our purposes of SEO forecasting is determining how many people make this purchase using organic search. (Note I focused on purchase because that’s the ultimate goal of SEO, but this exercise can easily be modified for traffic).

An assumption can be used here, or data if it is available to use that, but be conservative.

Once the audience has been narrowed to how many of that total might use organic search, this becomes the target market for SEO efforts. That target market could, of course, change but likely not in drastic ways over short amounts of time the way keyword search volume can be impacted by seasonality for a particular keyword.

I believe that SEO efforts should be focused on the people searching rather than their specific queries because each person that matches an intent might search differently. Still, the target market is the sum of the total. (I will dive into the specifics shortly)\

Buyers vs searches

The focus on people as buyers rather than units purchased is what makes this calculation less susceptible to short-term tastes. In the Gen Z clothing example, the number of purchases might change based on changes in appetite over a short time, but the total number of people that match that audience cannot increase steeply in a short period.

(Note, overall buyer tastes could suddenly change, such as Gen-Z males having a newfound interest in the same product, but that would be a different campaign and, therefore, a new TAM; the original TAM stays the same.)

Calculating SEO impact

Now that you have an actual TAM/target market in place that is sliced to just search engine users, you can use this to calculate the impact of an SEO effort. The target market is the upper limit where you capture 100% of the market, which is theoretically possible to get close to if the market is very niche with low competition, but more than likely not the case if you are in a competitive market.

This is where assumptions can be made based on hoped-for targets, but the entire model doesn’t break if the forecast is inaccurate. This assumption can just be updated. The beauty of a TAM-based forecast vs a keyword one is there are far fewer variables, and each variable has a logical backstory that can be supported and adjusted.

Market penetration rate

Our first assumption is going to be the market penetration rate. If the forecast is for an existing product and/or business, this assumption can be based on an assumed growth rate that aligns with other marketing channels. For example, if the performance marketing team is counting on an increase of 10% more traffic/users from advertising, you can add a 10% growth rate to the current market penetration rate. Using this growth rate, it is far more reasonable to say market penetration will go from 5% to 5.5% than to say market penetration will go to 10%, just because.

Even if you don’t have current market data from your performance to calculate a market penetration rate, you can use competitor data. This is not keyword research and a content gap analysis; this is a traffic/user/buyer gap analysis. You can use SimilarWeb to analyze traffic differences, but you might have to look at brand penetration data in a survey to analyze the competitive set.

How to use this data

If a well-funded competitor only has 5% of the market, you might want to manage expectations if you expect to get to 10%. On the other hand, if your product will easily disrupt a competitor with 50% of the market, you might not be aggressive enough if you think you will only get 10%.

One last note on market penetration assumptions is that this is a target for the end of a period. It could be one month, or it could be two years. You aren’t expecting to get to this number instantly, so as you build your forecast, you will want to scale the growth to this number.

Assumption data into action

With a targeted market penetration rate, you now have a hard user target, which you can apply additional assumptions to help you arrive at a revenue number. You can add in the number of searches for each of these users to get a traffic number if that’s required for a forecast, you can add conversion rates for users to get to a conversion number, and you can add average order value to get to a revenue calculation.

Using TAM forecasting, as you build your SEO plans for a new product, you can have precise targets that can continuously be adjusted in real time to keep you on track toward your goals.

In my next post, I will share tactics on how you can build SEO efforts to reach your TAM goals. Subscribe now if you are reading this online and are not yet getting this in your inbox.

[SPONSORED]

How to build Digital PR links in the sleep niche.

This campaign landed our e-commerce client in Lifehacker, and many UK national and regional news outlets.

This is how we've done it:

✅ We noticed that during summer, journalists write a lot about travel

✅ We knew we can leverage the trend to "hack" ourselves in the news agenda

✅ We just had to find a way to connect travelling with sleep

💡 Idea: How to fall asleep on the plane while travelling