Google is a monopoly, so what? Part 1

The DOJ’s case against Google revolved around allegations that the company violated Section 2 of the Sherman Act.

This week’s newsletter is sponsored by the Digital PR agency Search Intelligence, which uses PR methods to grow a link portfolio and North Star Inbound, which is a recommended agency for SEO and content strategy. See their case studies linked in the newsletter.

Featured links:

Domestika discounted my SEO basics course to $.99 - check it out here.

Advertising slots are available in this newsletter, book them here.

I dropped my pricing for the rest of this week on Intro, book a call here.

We are in the middle of an exciting election year, so little attention is paid to even the most monumental news stories that otherwise might have dominated headlines at another time.

The Google monopoly decision is one of those. Most marketers likely already considered Google a monopoly but are only surprised that the court agreed.

I read the full decision; it was one of the more insightful pieces of information I have read on SEO in a long time. The judge's understanding of the nuances of “ranking” is better than that of many digital marketers.

This will be part 1 of 2 (maybe three if there are many questions) that discusses the critical aspects of this verdict and how marketers can use the learnings to succeed in their efforts.

This first post will discuss the general background and verdict, while next week’s post will dive into the key lessons I drew from it.

[SPONSORED by Search Intelligence]

We analysed hashtags to get massive links for our travel client with Digital PR.

This is exactly how we’ve done it:

▪ We analysed a list of 80 top hotels worldwide to establish which hotels have the most Instagram hashtags

▪ We used Muckrak and Roxhill to find journalists who write about travel

▪ We sent the email to thousands of such journalists

The pitch was well received, with an average open rate of over 35%.

Antitrust case background

For background, it's essential to understand this case and whether it matters for SEO or broader digital marketing.

The DOJ’s case against Google revolved around allegations that the company violated Section 2 of the Sherman Act by maintaining monopolies in general search services, search advertising, and general search text advertising. The central accusation was that Google used exclusive agreements to ensure its search engine was the default on almost every desktop and mobile device in the U.S. (the world, too, but this court only has US jurisdiction), thereby stifling competition and limiting consumer choice.

Legal ramifications

Declaring Google as a monopoly only matters if the government chooses to do something about it. The plaintiff is the Department of Justice, and much of the consequences are in their hands, including how they want to penalize Google with the court's agreement. Breaking up Google is an option, but academic scholars are torn on whether regulation interference will change things. Regardless, there are many avenues of appeal at this point, and the real-world impact is extended long into the future.

The verdict

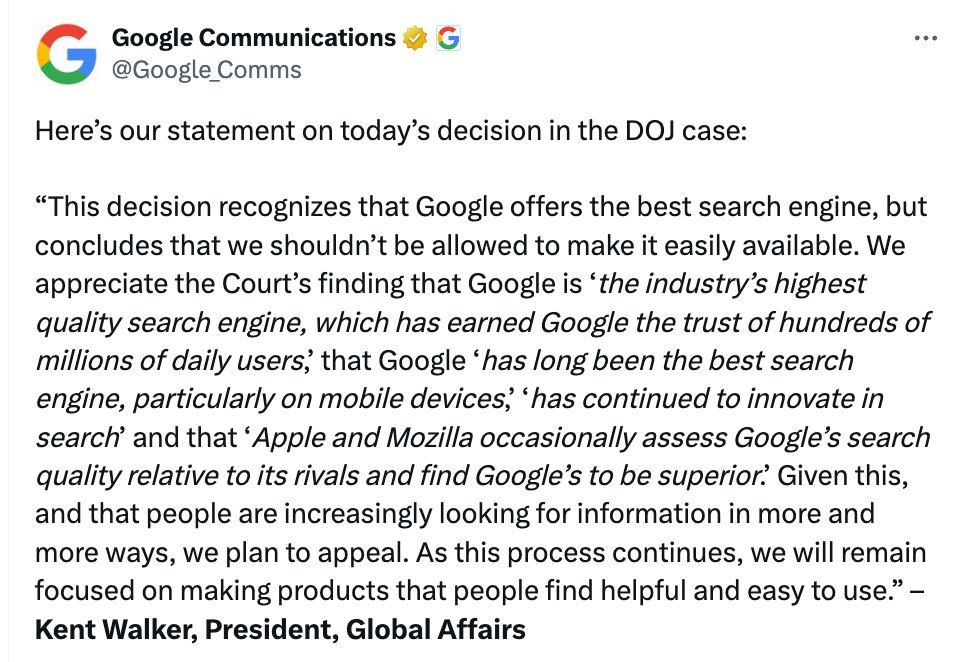

When the court first announced the verdict, Google responded in a way many marketers mocked. Google focused only on how great the court said they were and ignored the truly adverse verdict. It read almost like a bully bragging about their superior strength while being declared a bully.

After reading the entire 286 pages, I better understand why Google responded as it did.

Google search IS a great product

The court agreed in no uncertain terms that Google was a superior product without comparison; however, it also clarified that this didn’t absolve Google of its monopolistic behavior.

To be sure, Google’s brand recognition is due in no small part to its product quality. But as previously stated, “[t]he defendant’s innocence or blameworthiness . . . has absolutely nothing to do with whether a condition constitutes a barrier to entry” evincing monopoly power. AT&T, 740 F.2d at 1001.This glosses over the conclusion where the court was asked to consider sanctions against Google for some very concerning activities that do not support the argument that they are just a superior product and acted without malice.

Google intentionally did not maintain documents and deliberately obstructed some of the court's efforts.

When Plaintiffs speak of “systemic destruction of documents” they mean Google’s long- time practice (since 2008) of deleting chat messages among Google employees after 24 hours, unless the default setting is turned to “history on,” which preserves the chat. Id. at 76–78. This failure to retain chats continued even after Google received the document hold notice at the start of the investigative phase of this case. It was not until Plaintiffs moved for sanctions in February 2023, more than two years after filing suit, that Google changed its policy to automatically save all chats of employees under a legal hold.Google trained employees to add lawyers to sensitive communications on revenue share agreements to force these conversations to become “privileged.”

Google trained its employees to add its in-house lawyers on “any written communication regarding Rev Share [RSA] and MADA.”.... It also instructed that, when “dealing with a sensitive issue” via email, to “ensure the email communication is privileged” employees could add a “lawyer in [the] ‘to’ field,” “mark ‘Attorney/Client Privileged,” and “ask the lawyer a question.”Google also trained their employees on avoiding antitrust buzzwords

In addition to these two practices, Plaintiffs also point out that, for years, Google has directed its employees to avoid using certain antitrust buzzwords in their communications.....For example, in March 2011, Google prepared a presentation titled, “Antitrust Basics for Search Team,” which directed employees to “[a]void references to ‘markets,’ or ‘market share’ or ‘dominance,’” “[a]void discussions of ‘scale’ and ‘network effects,’” and “[a]void metaphors involving wars or sports, winning or losing.”The court declined to impose sanctions on Google for these anti-competitive practices because it would not impact their finding, but they closed with this warning to Google:

The court’s decision not to sanction Google should not be understood as condoning Google’s failure to preserve chat evidence. Any company that puts the onus on its employees to identify and preserve relevant evidence does so at its own peril. Google avoided sanctions in this case. It may not be so lucky in the next one.

What does this mean for marketers:

Aside from the exciting drama and direct language to Google, I think there is an interesting takeaway here. This shows that there can be two truths about Google: it is a superior product, but Google and its employees also blatantly disregard the public and the advertisers that fuel their growth.

This might be vindicating to those who claim, “Google is out to get them,” but this doesn’t pay the bills.

Why does it matter if Google is a monopoly?

According to the court, by using its monopoly powers, Google did two things that are detrimental to the search world:

They were able to charge advertisers more

The trial evidence firmly established that Google’s monopoly power, maintained by the exclusive distribution agreements, has enabled Google to increase text ads prices without any meaningful competitive constraint. There is no dispute that the cost-per-click for a text ad has grown over time..... What’s more, there is no evidence that any rival constrains Google’s pricing decisions. In fact, Google admits it makes auction adjustments without considering Bing’s prices or those of any other rival.Google’s increasing revenues allowed it to grow and reinvest in its products while preventing competitors from doing the same.

Unconstrained price increases have fueled Google’s dramatic revenue growth and allowed it to maintain high and remarkably stable operating profits.Suppose a remedy to Google’s monopoly ever occurs. In that case, it will benefit marketers as Google will have less ability to control pricing, and competitors might have more budget to invest in their own products.

The verdict explains this as follows:

Consider the following hypothetical (in whole numbers). Say, an advertiser values an ad at $10. That advertiser would be willing to pay up to $9 for the ad. A second-price auction, however, could result in a final price that is lower, say $5, because the runner-up has capped its price at that amount. Google has endeavored through the years to capture the “headroom” between the ad’s value ($10) and its price. FOF ¶¶ 254–255. It has done that by using its tuning knobs to adjust the auction formula so that, in this hypothetical case, it would push the final ad price to upwards of $9. Google simply could not take this approach in a competitive market. If it did so, a rival could adjust its auction to charge the advertiser less for the same ad, say, $7. In the competitive market then, Google still could earn a profit from the sale of an ad, but it could not achieve the monopoly profits that it does presently in the absence of rivals.TL;DR

Google, the company that effectively impacts all digital marketing efforts, is officially the monopolist most marketers thought it was, but in the near term, expect nothing at all to change.

In reality, marketing might even be MORE challenging moving forward, as Google, already found guilty, no longer has any incentives to obscure its monopolistic tendencies. Without any alternatives, Google does have full pricing power on search advertising. With more secrets about organic algorithms in the open, it can be even stricter in what it does.

This decision could worsen things for advertisers and websites that depend on Google for their livelihoods, but not much will likely change.

Stay tuned for next week’s newsletter, which will summarize the specific exciting points from the decision.

Brought to you by North Star Inbound—the sales enablement SEO agency.

Other agencies waste your time producing 1000s of pages that don’t generate sales.

North Star Inbound is laser-focused on 10% of topics you can and MUST own to drive revenue.

And they use those to deliver ROI in months instead of years.

And if you need the content produced, they handle that, too.

BigRentz grew from 27K visits to over 400K, with SEO sales beating PPC.

A dental client went from 0 to $137K in monthly revenue from SEO in under a year.

Book a call for a free content audit and 10% off any engagement.